Update (02/03/2023)

Dear clients,

Here is some additional information about the post below, concerning the update of Amelkis Opera.

The update of our statutory consolidation settings under French GAAP, in order to comply with the new regulation related to the presentation of investment grants in equity and the presentation of financial statements, will be integrated in all standard databases whose users start with Axxx by Friday, March 3.

For the bases whose users begin with Bxxx – Cxxx – Dxxx – Exxx as well as the Axxx users having a specific Opera base, this update will be carried out on demand. Attention, the specific bases will have to be the subject of an estimate in order to apply the update to measure.

—-

Dear clients,

We would like to inform you that an update of Amelkis Opera has taken place.

We have updated the statutory consolidation parameters under French GAAP in order to comply with the new regulation relating to the presentation of investment grants in equity and the presentation of financial statements.

We present to you :

- The description of the new regulation related to investment subventions

- Various improvements and new presentations of the financial statements

- The new objects to be selected in OPERA

The description of the new regulation related to investment subventions

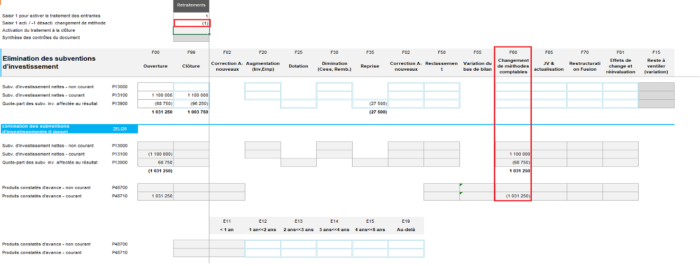

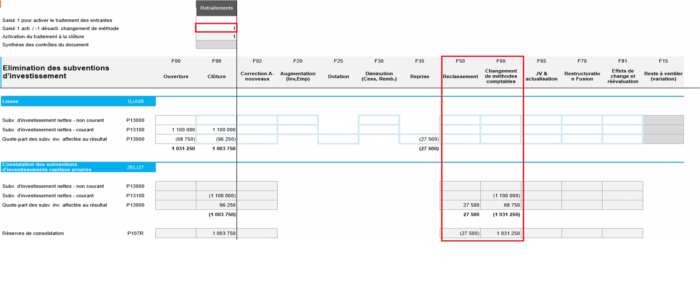

This new reporting package meets the requirements related to the implementation of the new restatement of investment grants in equity. This leads to the following changes :

- The deletion of the reclassification of investment grants as deferred income. Document 6-40 remains unchanged. However, you will have to put -1 on the change of method box in order to stop the restatement if it existed in 2022.

- Activation of the reclassification of investment grants in equity by using document 6-40E.

Various improvements and new presentations of the financial statements

2.1 We have enhanced the collection bundle (23F and 23D) with the following items :

- Creation of a new form 6.40E for the restatement of investment grants

- Adding a new package reprocessing :

– 2ELI27 “Restatement of investment grants in equity”.

- Creation of 3 new headings : the new package offers a better detail of the fixed assets headings.

– P14300 Provisions for Price Increases : Account to be Eliminated in the Regulated Provisions Form

– P16740 Conditional Advances from the State: Account positioned in “Other Equity”

– P16750 Equity Securities – Other Equity : Account positioned in “Other Equity”

2.2 A new correspondence table 2023 has been created to load these new fields

2.3 Presentation of reporting statements (balance sheet and income statement)

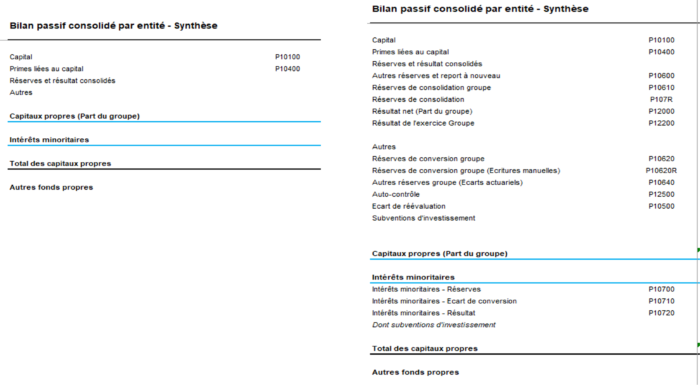

Balance sheet presentation (change only in liabilities)

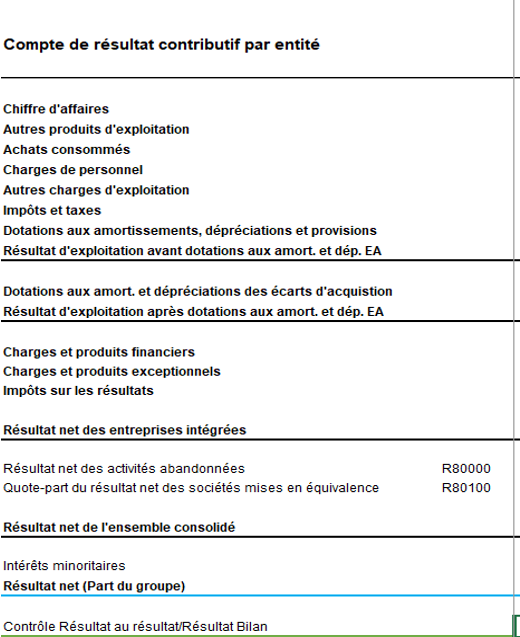

Presentation of the income statement

The new objects to be selected in OPERA

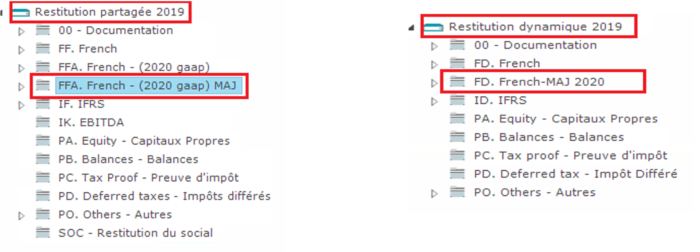

We ask you to be attentive to these 2 points and to use from now on only these objects for your new consolidations.

Creation of the fiscal year : from now on, when creating your fiscal year, you must use the following package: 23 F (or 23D) – Consolidation package I – Shortcut

Il ne faut plus utiliser les anciennes liasses. The old packages should no longer be used.

For the restitution, you will have to use the FFA – French (2020 Gaap) MAJ (for the fixed shared restitution) or FD – French MAJ 2020 (for the dynamic restitution).

The IFRS refund remains unchanged.